Consider adding: Crash insurance policy to fix or change your vehicle if it's harmed in an accident. Comprehensive insurance policy to cover the price of loss due to events out of your control, such as poor weather, vandalism, as well as wild pet damage.

affordable insurance companies car insurance vehicle

affordable insurance companies car insurance vehicle

Uninsured driver coverage. This safeguards New Jacket residents due to the fact that it has higher averages of uninsured/underinsured motorists as a result of greater typical expenses of auto insurance policy. My family stays in a really difficult time and also are driving in the most urbanized state in the united state with whole lots of website traffic. Crashes are simply that-- mishaps.

The state approves some educational programs to help in reducing your point offensives. Consider an insurance policy use program. This is a plug-in tool that will track your actual driving and customize a policy for you. Finally, devote to handling your stress, like with deep breathing exercises. Cars and truck insurance expenses are reflected in populace thickness and also urbanization, age (younger drivers have extra crashes because of requiring extra driving experience), as well as miles driven.

Because of this, numerous states have required that occupation, credit rating history, as well as rental condition be stopped as threat aspects used for identifying premiums. Still, further reform is required to stop the institutional bias of higher costs for a provided degree of threat to motorists of shade.

Finding one of the most budget friendly vehicle insurance coverage in New Jacket can be challenging, yet it isn't impossible (insurance). We have actually collected all the details you require to safeguard your vehicle, van, SUV, or auto at the most inexpensive rates feasible. Keep checking out to get more information about auto insurance policy requirements in New Jersey, together with how to discover one of the most budget friendly rates no issue your history or phase of life.

cheaper car insurance cheapest car low cost auto affordable auto insurance

cheaper car insurance cheapest car low cost auto affordable auto insurance

car insured auto trucks car

car insured auto trucks car

accident cheap car risks cheapest auto insurance

accident cheap car risks cheapest auto insurance

One Of The Most Affordable Vehicle Insurance for Teen Drivers Driving as a tee can be fun and exciting, but locating cost effective insurance coverage can take a little effort and time - cheapest auto insurance. Since teens lack significant time behind the wheel, car insurance providers are a little reluctant to provide insurance at an economical price. Fortunately, we have actually located four insurance coverage companies that supply the least expensive rates for teenager vehicle drivers in New Jacket.

What Does Average Car Insurance Cost In New Jersey - Insuraviz Mean?

When comparing prices of young motorists to teen drivers, you'll find that young drivers have a tendency to pay much less for vehicle insurance coverage than teen drivers (insurance). A young chauffeur guaranteed by Plymouth Rock Guarantee will certainly pay a monthly price of $220/mo, while a teen vehicle driver has to pay a premium of $294.

The Very Best Prices for Retired NJ Drivers Automobile insurance policy for retirees can become a bit more expensive once you hit 65 years old. Do not let this anxiety make you really feel burnt out throughout what ought to be a delightful time of your life. All you have to do is a little bit of research to discover the most affordable auto insurance coverage rates offered.

Because you are possibly investing less time when traveling, you may get a low-mileage discount, along with others. Ask your insurance policy company regarding all offered discount rates as well as do a little bit of contrast purchasing to locate the cheapest cars and truck insurance coverage rates offered for you. Cheapest Auto Insurance for Married Drivers Celebrating a marriage has several advantages.

$20 may not appear like a lot, yet this will quickly include up. For many years, a solitary motorist insured by Metromile will pay $240 more in automobile insurance policy! That's cash that could go towards grocery stores, paying off debt, or clothing for the youngsters. If you're a single driver, this doesn't indicate that you're doomed to paying too much on automobile insurance coverage.

The A Lot Of Economical Prices for Men vs. Females in New Jacket Surprisingly, some males in New Jersey pay slightly less for insurance coverage than females, excluding younger chauffeurs, whose rates tend to be extra expensive - cheap. Statistically, males are much more most likely to drive without their Visit this link seatbelt as well as obtain into even more accidents, their insurance rates are still cheaper than for women.

In a year's time, that's an added $400 in insurance policy prices! As you see, prices can differ, even amongst the least expensive alternatives, so be sure to look around to find the most effective alternative for you. The Cheapest State Minimum Protection in New Jacket Are you looking for a minimal obligation plan for your vehicle? You can anticipate to conserve majorly compared to a complete protection policy (business insurance).

New Jersey Car Insurance Coverage - Allstate - Questions

Insurance provider use aspects like age, sex, and driving background to identify your monthly rate, and also this can bring about you enjoying less costly prices from an insurance provider. The Most Inexpensive Complete Insurance Coverage Cars And Truck Insurance Business in NJ If you require to protect you as well as your car while when traveling complete coverage car insurance policy might be just what the doctor gotten.

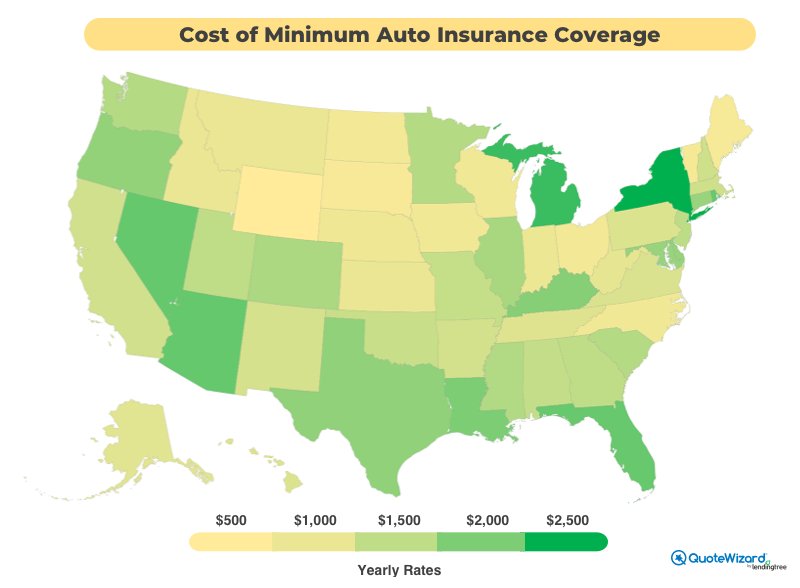

Ask your insurance firm concerning any kind of price cuts you get to get additional financial savings on your insurance costs. The Most Effective Cars And Truck Insurance Provider in New Jersey for 2022 New Jacket drivers have the most costly automobile insurance premiums in the nation. So, determining the best-rated cars and truck insurance provider to pick for your automobile is serious. insurance companies.

Spend some time out of your day to look for the very best automobile insurance coverage for your needs. Common New Jersey Vehicle Insurance coverage Discounts Many automobile insurance policy firms supply unique price cuts that enable vehicle drivers to save on their insurance policy costs. These offers usually fall under three basic groups: policy discounts, chauffeur discount rates, and automobile discounts.

Lasting clients are rewarded with cost savings of approximately 30% as a benefit for sticking with their present insurance provider. Packed Plan Discount Rate. Insurance provider offer this discount when you get multiple insurer from them. The most usual bundles are home and automobile. Still, they can consist of medical insurance, life insurance, boat insurance coverage, mobile house insurance, as well as occupants insurance.

Serving your nation can aid you lower your insurance policy rates. Energetic responsibility as well as retired participants of the armed pressures get a discount for their service as well as sacrifice. Federal Government Staff Member Discount Rate. Are you an existing or previous employee of the government, state, or city government? If so, you can receive less costly rates on your car insurance coverage.

Safe motorists who enable their insurance policy company to collect data through a monitoring gadget can see a decrease in the rates. insured car. The information tracks your driving patterns such as miles driven, rate, hard stopping, velocity, the moment of day or evening you drive, as well as the variety of hours driven. New Car Discount.

Indicators on Reformers Call For End To Discriminatory Pricing In Nj Car ... You Need To Know

If your insurance coverage does not cover the entire case, you'll be responsible for paying the rest out of your pocket - prices. It's your obligation to contrast multiple car insurance policy prices quote to find the appropriate insurance coverage with the most effective rates. Penalties for Driving Without Insurance Coverage in New Jersey In New Jacket, the law requires you have at the very least the minimum insurance protection as shown over.

You'll likewise be needed to offer proof of insurance within 1 day or your auto can be taken. If they confiscate your vehicle, you'll need to dish out an added $100 in administrative fees as well as provide evidence of insurance policy to get your automobile back (perks). The 2nd or succeeding times you are captured driving with insurance in New Jacket, anticipate to dig deep in your pockets and also dish out approximately $5000 in fines.

Some purchasers will also locate themselves with extra charges such as sales tax, documentation charges, individual residential property tax obligation, discharges as well as inspection costs, hybrid as well as electrical car costs, lien recording charges, and a multitude of other costs. Have a look at's thorough lorry expenses breakdown to make certain you make up all the included fees you could be responsible for when acquiring an auto in New Jacket - insurers.

You can read extra about the insurer in our Geico insurance evaluation. # 2 Progressive Progressive offers the cheapest typical rates for car insurance policy in New Jacket, particularly for drivers with bad credit rating (auto insurance). The business has a large range of cars and truck insurance coverage discount rates for vehicle drivers and also a usage-based program called Snapshot, which figures out drivers' cars and truck insurance coverage rates based on how safely they drive.

What's the Finest Cars And Truck Insurance in NJ? Finding the most effective car insurance policy in NJ starts with contrasting the business in your area. When contrasting, make sure to evaluate their consumer solution ratings and also vehicle insurance coverage rates. Whether you're looking for brand-new auto insurance policy in New Jacket or you've just moved to the Yard State, we can assist.

The Hartford has been shielding AARP members in New Jersey as well as their households with vehicle insurance since 1984. insurance affordable. During this time, we have actually earned a reputation for integrity and also depend on.

Getting The New Jersey Cheap Car Insurance Provider To Work

This means that if you're in an auto accident, each vehicle driver will certainly need to file a claim with their very own insurance - cheapest car insurance. (PIP), can cover medical insurance coverage deductibles for bodily injuries and lost salaries for any person in your automobile that is harmed.

4 New Jacket Safety Belt Regulation It is required that you use a safety belt while driving the roads of New Jacket. All guests in your car should also use a safety belt, consisting of those in the rears (liability). New Jersey Distracted Driving Regulation New Jacket has stringent laws to prevent sidetracked driving and assist protect against fatalities as well as injuries.

New Jersey state law needs proof of your auto insurance policy if you're in a crash (affordable car insurance)., you can keep your automobile insurance ID cards right on your phone.

Common Concerns About Car Insurance Policy in NJ What is the Average Expense of Vehicle Insurance Policy in New Jersey? Your car insurance prices in the garden state will certainly depend on the kind and level of coverage you choose.

Driving documents, zip codes as well as debt ratings can all affect the total you pay. What Is the Finest Automobile Insurance Coverage in NJ? When contrasting car insurance prices quote in NJ, you should likewise examine right into the insurance policy firm's economic stamina rating and consumer satisfaction degree.

You can depend on The Hartford for your automobile insurance coverage in New Jacket. We'll exist when you require us most.

Some Known Details About New Jersey Car Insurance Coverage - Allstate

New Jacket car insurance regulations call for that all vehicle drivers bring the state-required minimum insurance coverage limits. Any kind of lapse in insurance will certainly force insurer to pass that information to the state, which might impose costs as well as penalties. New Jersey provides 2 alternatives, typical and fundamental, to its residents that satisfy the state-required minimum.

insurance affordable car low cost auto cheaper cars

insurance affordable car low cost auto cheaper cars

We very advise responsibility coverage well over state minimums for greater satisfaction. State minimums may not suffice to pay for all problems incurred in a severe crash. All registered New Jersey drivers are needed to bring proof of insurance policy. Added, leased vehicle motorists might undergo extensive, crash, as well as building damage limitations well above state minimums.

What Factors Does New Jacket Law Allow in Identifying Your Costs? New Jersey sets insurance rates for business, yet the law permits insurance provider to identify the quantity of premiums you pay based on several elements. insurance. Some of one of the most essential variables include your age, gender, zip code of residence, as well as claims document.